If the Mag 7’s revenue growth rate does indeed peak in Q1 2026 and begins to decelerate, the most likely implication would be a significant drag on the S&P 500, causing the index to stagnate or even decline, regardless of what the other 493 stocks are doing.

As we approach the end of Q3 2025, fresh analyst forecasts and recent quarterly reports indicate a critical inflection point: the aggregate revenue growth RATE of the Mag 7 is peaking, with the apex projected around Q1 2026. This milestone, characterized by a shift from explosive double-digit growth to more moderate single-digit expansions, stems from a confluence of factors including maturing AI hype, intensifying competition, regulatory pressures, and macroeconomic uncertainties such as potential recessions or trade tariffs. While the group continues to generate substantial absolute revenue – projected to climb from approximately $1.7 trillion in 2023 to over $2.6 trillion by 2027 – the deceleration in year-over-year (YoY) percentage growth signals the end of the hyper-growth era that defined the post-pandemic recovery. This development has profound implications not just for these companies but for the broader market, particularly the S&P 500, where the Mag 7’s outsized weight could act as a significant drag, potentially leading to stagnation or decline in the index despite positive performance from the remaining 493 stocks.

In the dynamic world of global finance and technology, the “Magnificent Seven” – Alphabet (Google’s parent company), Amazon, Apple, Meta Platforms (Facebook’s parent), Microsoft, Nvidia, and Tesla – have long been the undisputed titans driving innovation, market valuations, and investor enthusiasm. These companies, often abbreviated as the Mag 7, encompass a diverse array of sectors: from search and digital advertising (Alphabet) to e-commerce and cloud computing (Amazon), consumer electronics and ecosystem services (Apple), social media and metaverse ambitions (Meta), enterprise software and AI integration (Microsoft), semiconductor leadership in AI chips (Nvidia), and electric vehicles with autonomous driving potential (Tesla). Over the past decade, they’ve not only reshaped industries but have also been the primary engines behind the S&P 500’s remarkable ascent, contributing disproportionately to the index’s gains amid economic upheavals like the COVID-19 pandemic, supply chain disruptions, and geopolitical tensions.

The Mag 7’s Q1 2026 revenue peak marks a maturation, not collapse

The Mag 7’s journey to dominance began in earnest during the 2010s, accelerated by digital transformation trends. Alphabet revolutionized information access and advertising; Amazon disrupted retail and pioneered cloud services through AWS; Apple built an unparalleled ecosystem around the iPhone; Meta connected billions via social platforms; Microsoft pivoted to cloud and productivity tools; Nvidia emerged as the AI hardware kingpin; and Tesla spearheaded the EV revolution. Collectively, their revenues exploded from under $500 billion in 2015 to over $1.1 trillion by 2020, even as the world grappled with lockdowns. The pandemic supercharged this growth: remote work boosted Microsoft and Amazon’s cloud revenues, online shopping surged Amazon’s e-commerce, and digital ads rebounded strongly for Alphabet and Meta. Nvidia’s GPUs became essential for AI training, while Tesla capitalized on green energy incentives. By 2022, amid economic reopening, the group posted record gains, with aggregate revenue jumping 47% YoY in 2021 alone.

However, cracks began appearing in 2022-2023. Inflation, rising interest rates, and supply chain issues led to a brief stagnation, with aggregate revenue dipping slightly in 2022 before a modest 1.7% recovery in 2023. Apple’s iPhone sales faced saturation, Tesla encountered EV market competition from legacy automakers, and Meta dealt with ad spend volatility. The real resurgence came in 2024, fueled by the AI boom: Nvidia’s revenue skyrocketed over 125% as data centers clamored for its chips, Microsoft integrated AI into Azure and Office, and Alphabet enhanced search with generative tools. Aggregate growth hit 17.6% that year, pushing total revenue to nearly $1.95 trillion. Analysts, drawing from sources like FactSet and Bloomberg, project continued expansion, but at a tapering pace: 19.8% in 2025 to $2.33 trillion, then decelerating to 17% in 2026, 15.3% in 2027, and stabilizing around 14-15% thereafter.

When revenue growth decelerates the narrative breaks

Delving deeper into the causes of this peak, several interrelated factors emerge. First, the AI enthusiasm that propelled 2024-2025 growth is maturing. Nvidia, the poster child, saw revenues quadruple from AI chip demand, but as enterprises move beyond initial investments, growth normalizes. Analysts from GroupM note global ad spending – crucial for Alphabet and Meta – rising 5-8% in 2025, down from pandemic highs. E-commerce, Amazon’s core, is projected at 23% of retail by 2027 per eMarketer, but saturation looms. Apple’s iPhone upgrades, tied to AI features, may spike in 2025-2026 but then stabilize. Tesla’s energy storage grows, yet auto margins erode from competition.

Regulatory and macroeconomic headwinds exacerbate this. Antitrust scrutiny on Alphabet and Meta could limit acquisitions; tariffs might hit Apple’s supply chain; and higher interest rates curb capex. Geopolitically, U.S.-China tensions affect Nvidia’s exports and Tesla’s Shanghai operations. Internally, rising costs – Meta’s metaverse R&D, Microsoft’s AI integrations – pressure margins despite revenue gains.

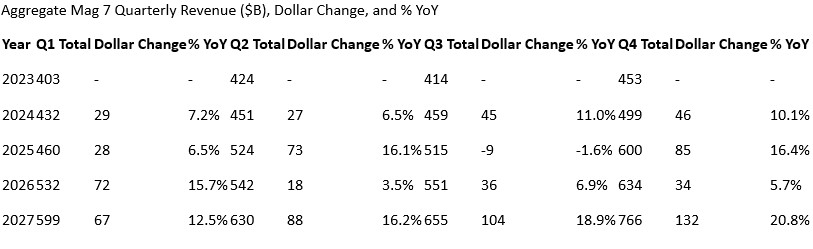

This peaking is vividly illustrated in quarterly breakdowns. In 2023, quarterly aggregates hovered between $400-450 billion, establishing a baseline amid post-pandemic normalization. Growth picked up in 2024, with YoY percentages ranging from 6.5% to 11%, adding about $148 billion across the year. Nvidia’s triple-digit surges in data center sales and Meta’s ad rebound offset Apple’s occasional dips due to China market challenges. By 2025, acceleration is evident: Q1 saw 6.5% growth to $460 billion, Q2 jumped 16.1% to $524 billion amid strong AI investments, but Q3 dipped slightly to 12.2% at $515 billion, reflecting seasonal factors and emerging saturation. Q4 2025 is forecasted at a robust 20.2% to $600 billion, driven by holiday sales boosts for Amazon and Apple, and year-end enterprise spending for Microsoft and Nvidia.

The peak arrives in Q1 2026 at 15.7% YoY growth to $532 billion, marking the highest relative gain before a sharp slowdown. Q2 2026 is projected at just 3.5% to $542 billion, influenced by Nvidia’s growth moderating from 113% in 2025 to around 59%, as AI shifts from training to inference phases. Subsequent quarters recover somewhat – 6.9% in Q3 and 5.7% in Q4 – but the trend is clear: percentage growth will hover in the low teens by 2027, with Q4 reaching 20.8% on a larger base but absolute dollar additions stabilizing at $400-500 billion annually. This trajectory assumes conservative analyst consensus from firms like BofA and McKinsey, which forecast hyperscaler capex rising to $414 billion in 2025 but potentially plateauing if ROI on AI diminishes.

To visualize this, consider the following aggregate table, compiled from analyst estimates and recent reports (sources: FactSet, Bloomberg, LSEG):

Aggregate Mag 7 Quarterly Revenue % YoY Change

This table underscores the 2026 Q1 peak, with subsequent moderation reflecting broader market dynamics. For instance, Nvidia’s Q1 2026 revenue is expected to grow 69% YoY but slow thereafter; Amazon’s AWS might see 13% growth amid competition from Azure; Apple’s services could offset hardware plateaus; Meta’s ad revenues face regulatory hurdles in Europe; Microsoft’s cloud expansion continues but at 15% clips; Alphabet’s search dominance persists yet matures; and Tesla’s EV deliveries rebound with Robotaxi prospects but contend with price wars.

If the Mag 7’s revenue growth rate has indeed peaked and begun to decelerate, the most likely implication would be a significant drag on the S&P 500, causing the index to stagnate or even decline, regardless of what the other 493 stocks are doing. Here’s the breakdown of why this would happen.

The “Weight” Problem (Index Concentration) The S&P 500 is a market-capitalization-weighted index. This means the largest companies have an enormous, outsized impact on its performance.

Extreme Concentration: As of late 2025, the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) account for over 35% of the entire S&P 500’s value, up from 30% earlier in the year according to Morningstar and Schwab data.

The Math: Because of this, the performance of the S&P 500 is less about the “average” US large-cap company and more about the collective performance of these seven stocks. The positive performance of the “other 493” stocks can be (and has been) completely canceled out by a bad day for the Mag 7.

If this 35%+ slice of the market shifts from “high growth” to “slowing growth,” it acts like a massive anchor on the entire index. Historical parallels abound: during the dot-com bubble of the late 1990s, the top tech stocks drove the Nasdaq to highs, but their bust led to a 78% plunge despite resilience in other sectors. Today, with concentration levels rivaling those peaks (per Ned Davis Research), a similar re-rating could unfold.

The “Valuation” Problem (Multiple Compression) This is the most critical part of the scenario. For high-growth stocks, the rate of acceleration matters more than the absolute growth.

Premium Prices: The Mag 7 trade at very high valuation “multiples” (like high Price-to-Earnings ratios). Investors are willing to pay these premium prices today because they are projecting rapid growth far into the future. As of October 2025, the group averages 35x forward earnings, versus 20x for the broader S&P, per FactSet.

The Re-rating: When revenue growth decelerates (even if it’s still positive, say 15% instead of 40%), the narrative breaks. The market will “re-rate” the stock, deciding it no longer deserves a hyper-growth multiple.

Multiple Compression: This is the key term. A stock can still be growing its earnings, but its stock price can fall dramatically as its P/E multiple shrinks to reflect the new, slower-growth reality. The price drop comes not from a lack of profit, but from a lack of accelerating profit. For instance, if Nvidia’s growth slows from 100%+ to 20%, its multiple could compress from 50x to 25x, halving the stock price even with rising earnings. Analysts at Columbia Threadneedle highlight that while current valuations are supported by strong earnings power, a deceleration could trigger 20-30% drawdowns.

The Likely Market Reaction: A “Great Rotation” If the Mag 7 are no longer the source of market-beating returns, investor money would quickly move elsewhere. This would likely trigger two major effects:

Sector Rotation: Money would flow out of the mega-cap “Growth” and “Technology” sectors and into long-neglected sectors like Value, Small-Caps, Industrials, or Financials, as investors hunt for the “next” leadership group. We’ve seen glimpses in 2025, with small-caps outperforming during rate-cut expectations.

The “Equal-Weight” Outperforms: You would almost certainly see the S&P 500 Equal Weight Index (like RSP) begin to dramatically outperform the standard S&P 500 (like SPY or VOO). The equal-weight index gives every company a 0.2% weighting, so its performance would suddenly be driven by the “other 493” stocks, which would be unshackled from the decelerating Mag 7. Data from AXA IM shows the S&P 493 catching up to Mag 7 growth at 16% for 2025, potentially shining in a rotated market.

In short, the S&P 500 index itself would likely perform very poorly, masking the fact that hundreds of other companies within it might be doing just fine. Projections from LSEG peg S&P earnings at $263 per share for 2025, up 11%, but if Mag 7 underperforms estimates (17.8% growth vs. 10.7% revenues per Earnings Trends), the index could return only 8-10% annually, down from 15%+ recently. Volatility could spike, with bubble fears amplifying sell-offs.

Yet, this peak doesn’t spell doom. The Mag 7’s fundamentals remain strong: diversified revenues, massive cash reserves (over $500 billion combined), and innovation pipelines. Microsoft and Alphabet could monetize AI further; Amazon’s AWS dominates; Nvidia pivots to edge computing; Tesla’s energy and autonomy segments grow; Apple expands services; Meta advances VR/AR. If capex translates to ROI – as Roundhill Investments monitors – growth could reaccelerate. Beating 2026 estimates (14.5% earnings per FactSet) might delay the slowdown.

Expert voices echo caution with optimism. “The Mag 7’s concentration is a double-edged sword,” notes a Barron’s analyst, “supporting gains now but risking corrections.” Forbes warns of diversification needs, while Nasdaq highlights Q3 2025’s 14.9% earnings on 7.8% revenues as solid but not spectacular. Historical resilience – post-2022 dip, the group rebounded – suggests adaptation.

The Mag 7’s Q1 2026 revenue peak marks a maturation, not collapse. For the S&P 500, it could usher in a “great rotation,” fostering broader participation and reducing risks. Investors should diversify, monitor earnings beats, and view this as evolution in tech’s enduring saga. As these giants adapt, their influence persists, but in a more balanced market landscape.